There have been stories of hedge funds and big banks putting pressure on the single family housing market by coming in and purchasing properties for cash to add to rental portfolios. I have heard it from other Realtors, investors, and home buyers alike. The rumor is that by doing this, the institutions have driven up the prices, and once they decide to start selling off these properties, prices will crash. Is this the reality of the situation?

The National Multifamily Housing Council tracks statistics of US households. Some of the statistics they keep are based on owner-occupancy, renter-occupancy, what type units are rented, and ownership of institutional investors, among many other rental statistics.

When we look at 2015, the last year that data is available for, in the United States, there were 118,208,250 households. Of those, 43,701,738 were renter-occupied, which accounts for approximately 37%. Of those renter-occupied units, 15,177,698 of them were single family structures (Homes, Town homes, and Condos, units that are individually deeded and owned, so not multifamily properties).

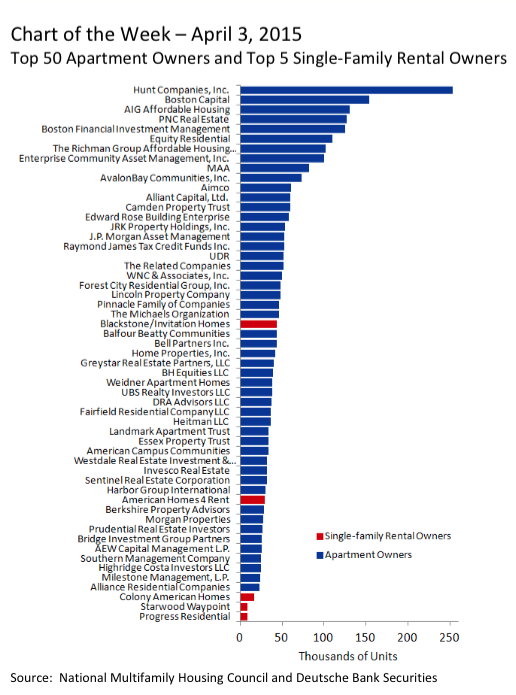

Now when we dig further into Institutional ownership of rental properties, we can see that the largest owners only have multifamily and apartment assets in their portfolios. In fact, only five of the top 50 portfolios are invested in single family units, as shown below.

These five largest investors account for approximately 108,000 single family units total. In fact, when we dig deeper, we find that there are a total of only 250 entities that own 250 or more properties, which accounts for approximately 260,000 properties. This is approximately 1.7% of the single family rental properties in the United States.

So that means the vast majority of rental properties are owned by smaller investors in smaller quantities.

Do I think if there were 260,000 additional properties that came to market across the country it might impact prices? Probably to a small extent, but I don't think it would be significant. The chances of them all coming on the market at once is highly unlikely, but even if they all did in the course of a year it would probably stabilize the price point that most of these homes are located in, since as we know the lower price point that investors, first time home buyers, and those looking to downsize, is currently the most competitive for buyers and, at least in Charlotte, has the lowest number of months of supply in history.

As always, if you or someone you know has any questions about our current market, whether to buy, sell, or invest, I am always available to answer those questions. Do not hesitate to contact me!