When I Googled "debt" looking for an image to put on this article, it wasn't surprising that I could not find a single one that showed debt in a positive light. Every image was of scissors cutting debt, people being crushed by debt, erasing the word debt, and other similar themes. We have been lead to believe that debt is evil, debt will crush you, and debt will never allow you to grow financially. Has debt become the worst four letter word in the English language? It certainly seems that way.

What do we think of when we hear about debt? Credit card bills, student loans, medical bills, car payments, and mortgage payments for the most part. These are all things we want to pay off as quickly as possible so we can start accumulating wealth, right? In my opinion, not exactly. Not everyone will agree with me here, but that is OK.

Debt can be a great tool to actually helping you build wealth, if it is the right kind of debt. The debt I am talking about is debt that is acquired to invest in income producing and appreciating assets. Of the debt items I listed above, the only one that fits this criteria would be mortgage payments. Certainly credit card debt, student loans, medical bills, and car payments are not going to help you build wealth, those will only take wealth away and should all be avoided to the greatest extent possible.

Good debt allows you to leverage your assets in order to produce greater returns on your investments. Let's take a look at assets and how we can leverage them.

Cash

Cash is not leveraged at all. This is money sitting in the bank making a measly 0.5% interest if you are lucky. Not much to talk about here. It is always good to have some cash on hand though to cover unexpected expenses. If you want to be really safe, have six months worth of expenses in cash or other liquid assets.

Stocks

These can be leverages if you have a margin account. A typical margin account will allow you to trade two times your cash deposit, or if you have over $25,000 and you qualify as a pattern day trader (make more than four round trip transactions per week), they will allow you to trade four times your cash deposit. If we use a hypothetical 6% annual return on your investment, you stand to actually gain 12-24% on your outlay. These are great returns but we should not forget the risk that is involved with the stock market and they will require a great deal of research and time spent managing.

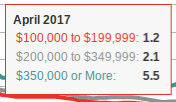

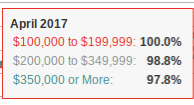

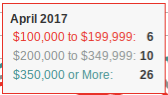

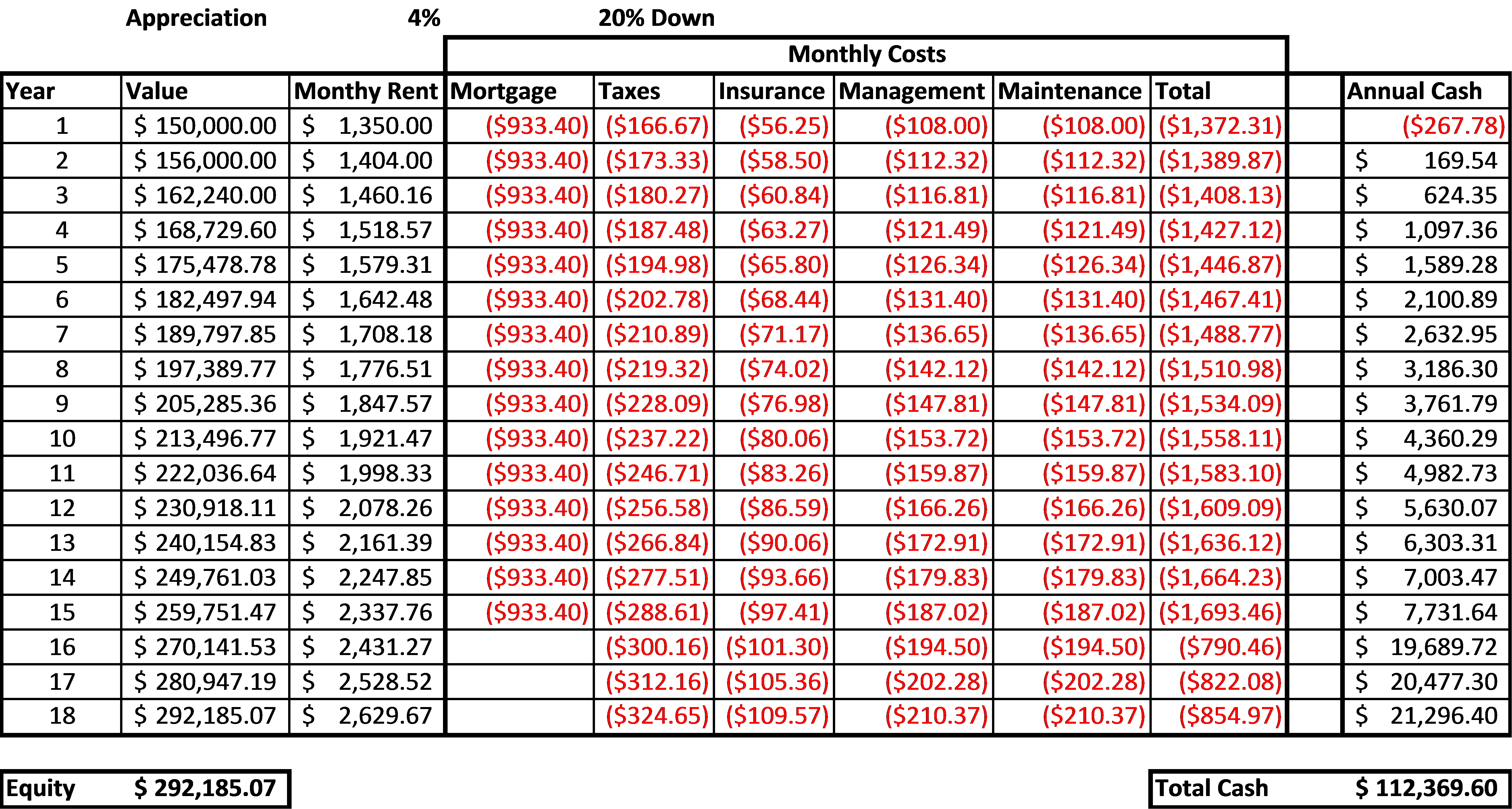

Real Estate - Investor

If you are an investor, banks will let you leverage your money about 5 to 1 (20% down on a mortgage). This means if you purchase an income producing asset, not only are you producing monthly positive cash flow, you are also having a tenant pay down your mortgage, which increases your equity position, as well as your asset most likely appreciating as well. If your property appreciates 5% this translates into a 25% gain on your investment, not including your cash flow and debt payoff. These will typically boost your return another 10-15%.

Can this be true? Let's look at some hypothetical numbers. You purchase a $100,000 house. You put 20% down ($20,000). The house appreciates 5% to $105,000, so your $20,000 investment is now worth $25,000, a 25% increase. On top of that, you earn $200 per month of positive cash flow. This is an additional $2,400 that year, or another 12% of your investment. In this scenario your $20,000 earned you $7,400 in the first year, a total return of 34%. Other than the time spent initially finding the home, this investment is pretty much hands off.

The beauty of it too, the longer you hold the property, the more rents increase, the more equity your tenants pay down (by covering your mortgage payments), and the higher the property will tend to appreciate, statistically speaking.

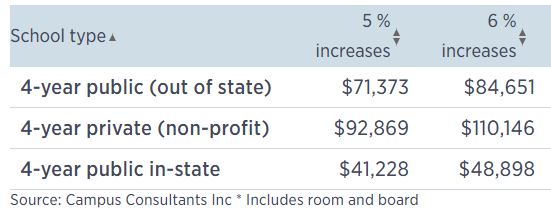

Real Estate - Home Owner

This is where we can see the greatest gains. As a homeowner, there are currently programs that will allow you to purchase a home for as little as 3% down. That's right, that means you are able to leverage your investment by OVER 30%. In this scenario, what you would typically pay in rent is paying down the cost of your home, and if you think about it you are fixing your rent for a long period of time. Instead of experiencing the typical 5% increase annually in rent, your payment will remain virtually the same for 30 years!

If we consider this scenario with our hypothetical house above where you invest $3,000 to purchase your $100,000 house and it increases in value to $105,000, your initial investment is now worth $8,000. That $5,000 gain on a $3,000 investment is a gain of 167%!! I don't know of any other investment vehicle that will allow you to make gains like that, do you?

For these reasons, it is no surprise that it is estimated that home owners have an average net worth of $225,000 while renters have an average of about $5,000. Home owners are investing using leverage to allow the growth of their assets create exponential growth in their net worth.

I truly wish I could have found an image of a man standing on a mountain of debt to show my opinion of the power of debt and the ability to create great wealth based on a solid foundation of properly used debt.