One of the things that I hear most often when comparing two rental properties with investors is "this one is cheaper, doesn't that make it a better investment?" While you may be able to purchase a house and fix it up to gain instant equity, when evaluating a rental property this is not always the best scenario for the investor. Lets examine two hypothetical properties to see how this can play out.

When an investor is financing a rental property, one of the key components to their evaluation is what their monthly cash flow will be and what percentage of their investment that cash flow is. If we think about the cash outlay for the two rental options we are discussing here, which one will require more? Obviously it will be the one that requires work to be done.

Property A is a fixer upper. Nothing major, just some cosmetic touch ups. It needs paint, flooring, appliances, and a good cleaning. Those repairs will take a few weeks after closing to get done and will cost around $7,000 for our hypothetical property. This property is listed for $113,000.

Property B is move in ready. It is clean, freshly painted, everything looks great. The only difference from Property A is that this one is listed at $125,000. This house will be ready to rent as soon as you close.

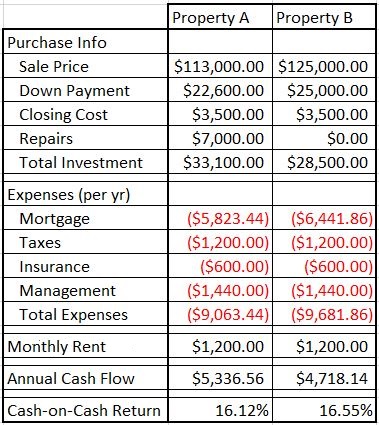

So which one is the better investment? There are two ways to look at it. The easiest way is to say, "Property A. For $120,000 I will be getting a property that is worth $125,000." This is true, and I wouldn't argue with you there, but let's look at it from a cash flow perspective and a cash-on-cash return. We will assume the same interest rate, closing costs, taxes, insurance costs, etc, for each of our two properties. Take a look at the table below:

The cash flow amount is about $50 a month less for Property B but as you can see in this scenario, the actual return on your investment is slightly better by paying MORE for this home. The reason behind this is because you are using leverage (the bank's money). Another consideration for this first year of investment is that you will likely lose a month's rent for Property A while your repairs take place.

The other great thing about this, as your rents increase over time, the cash-on-cash return of Property B grows faster than that of Property A. This won't always be the case, but it is always important to evaluate the returns of each property, and then even further, the returns of each property based on different down payments (20% vs 25%).

There are some cases where Property A will be a better option, namely if you plan to pay cash and not finance, or plan on purchasing, fixing, and financing after rehabbing (commonly known as the BRRRR Strategy).

If you have any questions about how to calculate these returns, where to find properties like this, or real estate investing in general, please do not hesitate to reach out to me.