One thing that is certain is that costs of college education is on the rise. It has been for a while now and is anticipated to continue to do so. Parents should start to consider the burden of this cost when their child is born. Delaying planning for these costs can cause a great deal of stress for both parents and their children. I'm sure no parent wants their child to begin their adult life under a massive pile of debt, but many times that is the case in the society we live in.

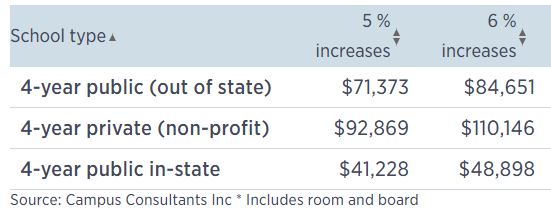

If we look at the anticipated cost of college in 2030 (which is only 13 years away now), expectations are an increase of 5-6% annually. This leads to annual costs for public and private schools as shown here:

This means a four year public school degree will cost roughly $200,000, while a private university degree will be pushing $450,000. If those dollar amounts aren't a tough pill to swallow, I envy you.

So how can we help plan for and pay for this education? At the average rate of return of 6% for 529 college savings plans, parents would have to invest $140,000 at the birth of their child in order to afford this $400,000 education. If you choose to invest over a period of 18 years, your contributions will have to be in excess of the $140,000. Again, a tough pill to swallow.

What if there were another way? Well, there is. We can use real estate!

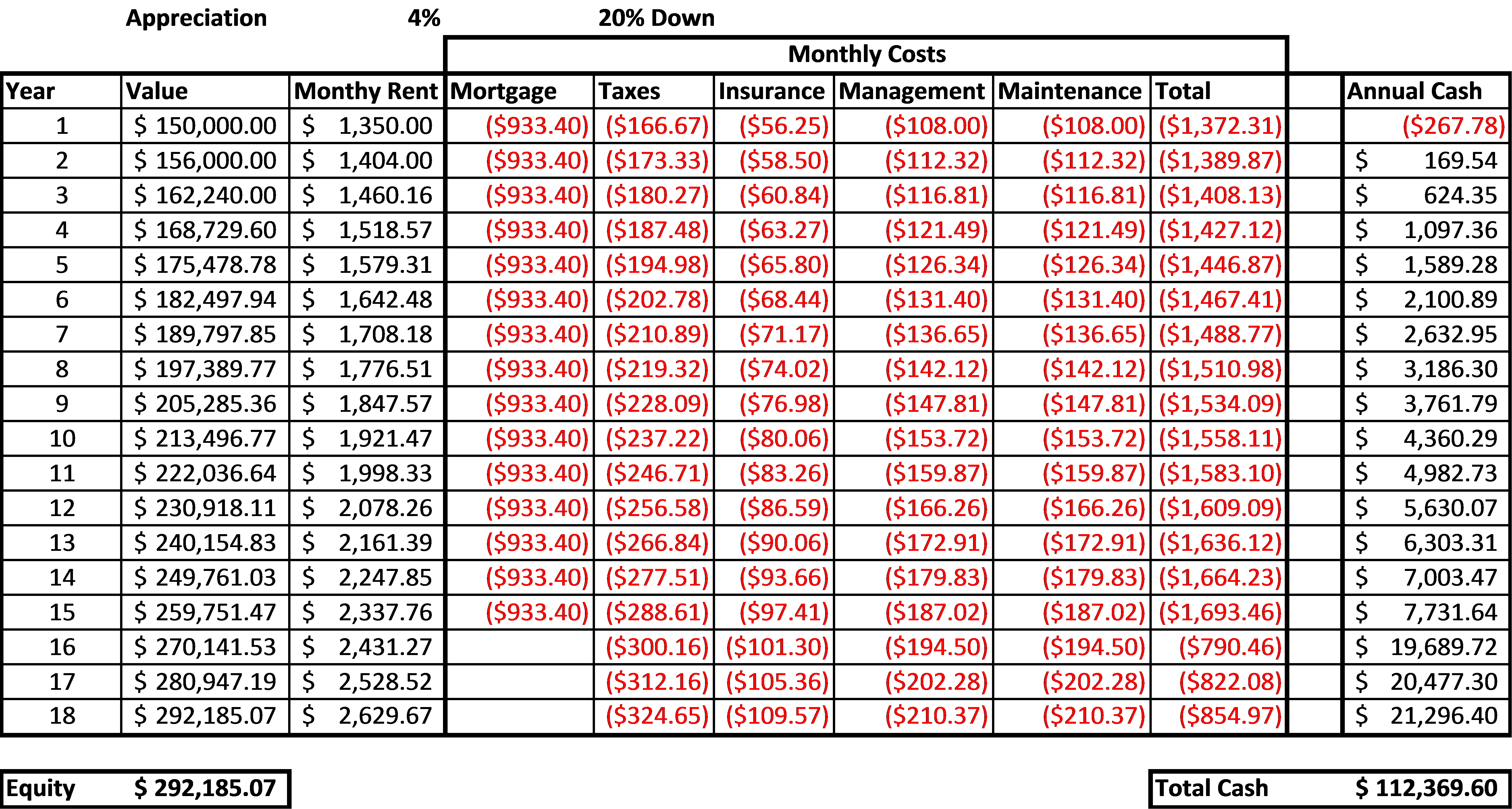

Suppose you were to make an investment in a rental property when your child was born. I know, a new child comes with many new expenses, but bear with me for a minute. We will use a hypothetical $150,000 property, purchased with 20% down with a 15 year mortgage, financed at 4.75% interest. This property will rent for $1,350 per month.

If we run this scenario with the property appreciating at a modest 4% per year (and rents and taxes increase annually at the same rate), here are the numbers for annual property value, rent, expenses, and cash flow.

Let your cash accumulate in this scenario. After 15 years, the property is paid off and your cash flow increases dramatically. At the end of our 18 year period, between equity in the property and cash proceeds, you will have accumulated almost $405,000 total. All for the initial investment of $30,000. This represents a 15.5% annual return on your investment, better than you will see from your typical 529 savings plan. The other great thing, is you re-invest your cash returns and pay down the mortgage sooner, your returns will increase further.

So, long story short, having a plan in place for your child's education from the time they are born, you will have the ability to allow them to go to pretty much any school they choose without you or them worrying about the cost. What greater gift can you give your graduating senior 18 years down the road?

If you have any questions about how you can make this happen for you and your family, do not hesitate to reach out to me. I would be more than happy to turn this hypothetical property into your reality!

No comments:

Post a Comment