My real estate career began with investing in buy and hold rental properties. To me, the monthly income that is produced by having a rental property is a great way to get into real estate without having to invest a great deal of time, and possibly without having to invest a great deal of money as well.

Recently I looked at four zip codes in Southwest Charlotte to see where investors were spending money, how much they were spending, and estimated what kind of returns they were seeing. There is so much data available through the Multiple Listing Service, and I felt sifting and sorting through this data would be important for me to understand our local market, both for myself and my clients. THIS DATA IS ALL ACTUAL CLOSED INFORMATION FROM THE MULTIPLE LISTING SERVICE.

Assumptions

In order to have a fair basis to compare, I normalized purchases that were financed to approximately what interest rates are now even though the rates that individual purchasers were probably different. I needed a way to look at everything on a level surface and that seemed like the most reasonable way to do it. I find that investment mortgages typically run 75 to 100 basis points (0.75% to 1%) higher than personal home loans. With 25% down, you would receive a better rate than with 20% down.

In future posts I will tell what terms I used as well, but for this initial one I used an interest rate of 5% and based the mortgage on a down payment of 25%. Currently, first home loans are running about 4.25%, so adding the 75 basis points, we get to right at 5%.

Other assumptions I made were what insurance would cost. Silmilar to interest rates, these rates will vary from person to person and property to property, but I included my normal figures to provide a starting point.

These calculations do not include vacancy, maintenance, and property management, but also do not include future appreciation or rent increases.

Actuals

I have used actual amounts for property taxes and HOA fees. These items are included in the listings so I could use the actual numbers.

Results

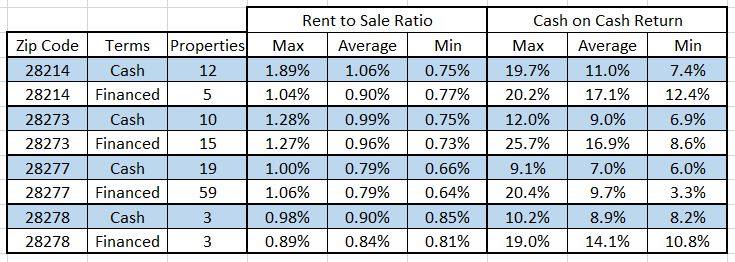

Here is a summary of what has sold in each of the four zip codes I examined. 28273, which has been a hot rental market for some time now, appears to still be a great place for investors looking for monthly cash flow on their investments.

I do have a spreadsheet with additional breakdown of each individual property for these zip codes, but posting an image if it would not do justice since it would be impossible to read. If you are curious to see the data, please don't hesitate to email me, tom.oneil@kw.com, and I will certainly pass it along. Also, if you have other Zip codes that I could provide a similar analysis on, please let me know.

No comments:

Post a Comment